2026 Charitable Deduction Changes: The Need to Know

Charity Record

charityrecord.com/The One Big Beautiful Bill Act (H.R. 1) made some big changes to U.S. charitable deductions starting in 2026.

If you itemize, there's a new floor that will affect smaller donations. If you're in the top tax bracket, there's a cap on your benefit. And if you take the standard deduction, a new above-the-line deduction for cash donations starts in 2026.

In this post, we'll break down the three changes and show you some concrete examples showing the 2025 vs. 2026 federal math.

And who are 'we'?

We're Charity Record – a modern charitable donation tracking tool (and ItsDeductible alternative, if you're looking!) built for taxpayers. We handle multiple donation types, can export to TXF for tax software as well as CSV, HTML, and PDF, and (as of this week!) model some of the 2026 tax changes automatically.

Naturally, we've been digging through the big, beautiful details.

The 0.5% AGI floor for itemizers

If you itemize, you can now only deduct charitable contributions that exceed 0.5% of your contribution base (your AGI without NOL carrybacks).

Example: Sarah's food bank donation

Sarah is a single filer who itemizes with a contribution base of $150,000. She donates $1,200 to her local food bank.

| 2025 | 2026 | |

|---|---|---|

| Floor (0.5% of contribution base) | $0 | $750 |

| Her $1,200 donation, deductible | $1,200 | $450 |

| Tax savings (24% bracket) | $288 | $108 |

That's $180 less in tax benefit on the same donation. The math: 0.5% × $150,000 = $750 floor, so only $1,200 - $750 = $450 is deductible.

The 35% cap for 37% bracket taxpayers

If you're in the 37% federal bracket, the benefit of all your itemized deductions (including charitable contributions) maxes out at 35%.

Example: Michael's year-end giving

Michael is married filing jointly with taxable income above $768,700 (the 37% threshold for 2026) and wants to make an end-of-year $10,000 donation. Assume his total charitable giving already exceeds the 0.5% floor before this gift, so the full $10,000 is deductible for this example.

| 2025 | 2026 | |

|---|---|---|

| Effective rate | 37% | 35% (capped) |

| Tax savings | $3,700 | $3,500 |

| Difference | — | -$200 |

That's not catastrophic, but $200 is $200. And remember, the 0.5% floor applies to his total giving, so his total deductible amount is reduced before the 35% limit.

Example: when you’re close to the floor

If your giving is near the floor, your deduction can shrink fast.

Example: Jen’s $1,000 donation

Jen itemizes and has a contribution base of $100,000. She donates $1,000.

| 2026 | |

|---|---|

| Floor (0.5% of contribution base) | $500 |

| Her $1,000 donation, deductible | $500 |

| Tax savings (22% bracket) | $110 |

Non-itemizers get a new above-the-line deduction (starting 2026)

There's good news if you take the standard deduction: a new above-the-line deduction for cash donations to qualifying public charities starts in 2026.

The temporary $300/$600 deduction from 2020–2021 expired after 2021, so this is a new benefit (not an increase from 2025). See the expiration note here.

Example: Tom and Lisa's church donation

Tom and Lisa are married filing jointly, take the standard deduction, and donate $1,500 cash to their church.

| 2025 | 2026 | |

|---|---|---|

| Above-the-line limit (MFJ) | $0 | $2,000 |

| Deductible amount | $0 | $1,500 |

| Tax savings (24% bracket) | $0 | $360 |

That's a genuine new benefit for non-itemizers starting in 2026. And unlike the itemized deduction, there's no 0.5% floor – your first dollar of cash giving counts.

One catch: The above-the-line deduction is for cash donations to qualifying public charities under IRC 170(b)(1)(A), and it excludes supporting organizations and donor-advised funds. If you donate stock, log volunteer mileage, or give other non-cash gifts, you'll need to itemize to claim those.

How the changes may affect different situations

The updates are generally small, but they matter depending on your situation:

If you itemize and donate modestly: The 0.5% floor will reduce the deductible portion of your giving. Some taxpayers might consider bunching donations (giving two years' worth in one year) or using a donor-advised fund to front-load contributions, but the right approach depends on your overall tax picture – Charity Record does not provide tax advice, consult a professional to discuss your situation.

If you're in the 37% bracket: The 35% cap is real but relatively minor. A $10,000 donation loses $200 in benefit (not including the floor). You don't give for the tax break, but charitable giving still makes sense on the tax side in 2026 if it made sense before 2026.

If you take the standard deduction: The details of the BBB make donating cash to public charities benefit you more with your taxes. Cash donations up to $1,000 ($2,000 MFJ) now reduce your taxes even without itemizing.

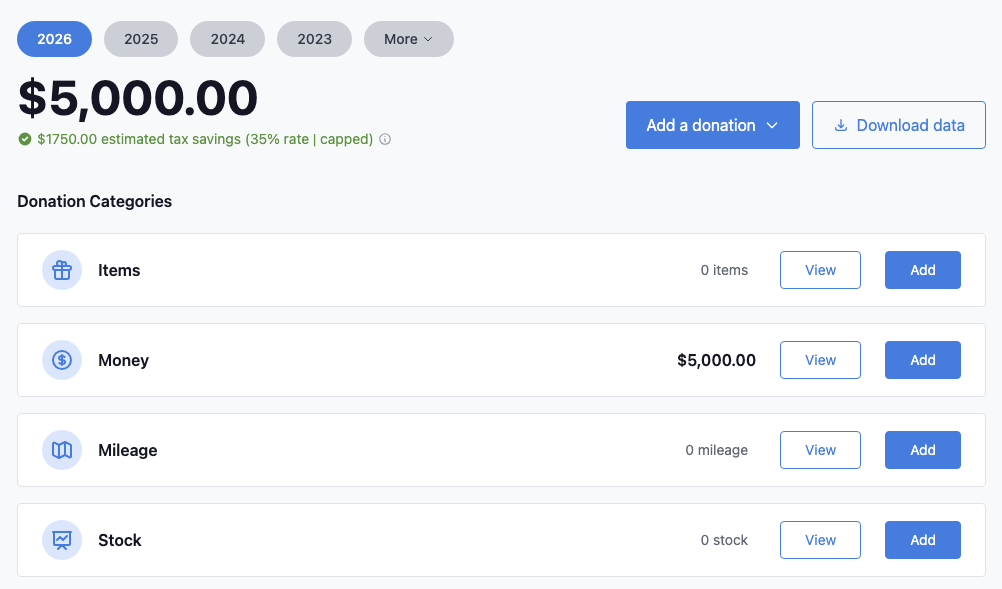

Tracking donations in 2026

Charity Record is ready for your 2026 giving. Cash donations, mileage, stock, household items – we track all of it the same way, and our tax estimates now reflect important 2026 rules automatically. If you're in the 37% bracket, you'll see "(capped)" next to your rate.

We don't model that 0.5% floor, though – we'd need your AGI and a fuller picture overall, and we don't collect that (here's why).

More details on our new 2026 estimates, here: How tax estimates work

Charity Record models the 35% deduction cap for the 37% bracket (but not the AGI floor)

Charity Record models the 35% deduction cap for the 37% bracket (but not the AGI floor)

State taxes

State tax treatment varies. Some states follow federal rules automatically and others don't. California, New York, and a few others have their own charitable deduction rules. Check with your state's tax authority or a local tax professional for clarity.

Tax laws are complex. This post is information, not advice – talk to a qualified tax professional for your specific situation.

Ready to track your 2026 donations? Charity Record handles all seven IRS donation types, exports to TXF for TurboTax and H&R Block, and imports your old ItsDeductible backups. We built it because we needed it, too!

About Charity Record

The Charity Record Team

Ready to track your donations?

Create a free account and start organizing your charitable giving for tax time.

Create Free AccountFree up to $500 in donations. No credit card required.