A Charitable Donation Tracker for Taxpayers

Stay organized and track charitable donations year-round. Estimate your tax savings. Export at tax time.

Updated January 16, 2026

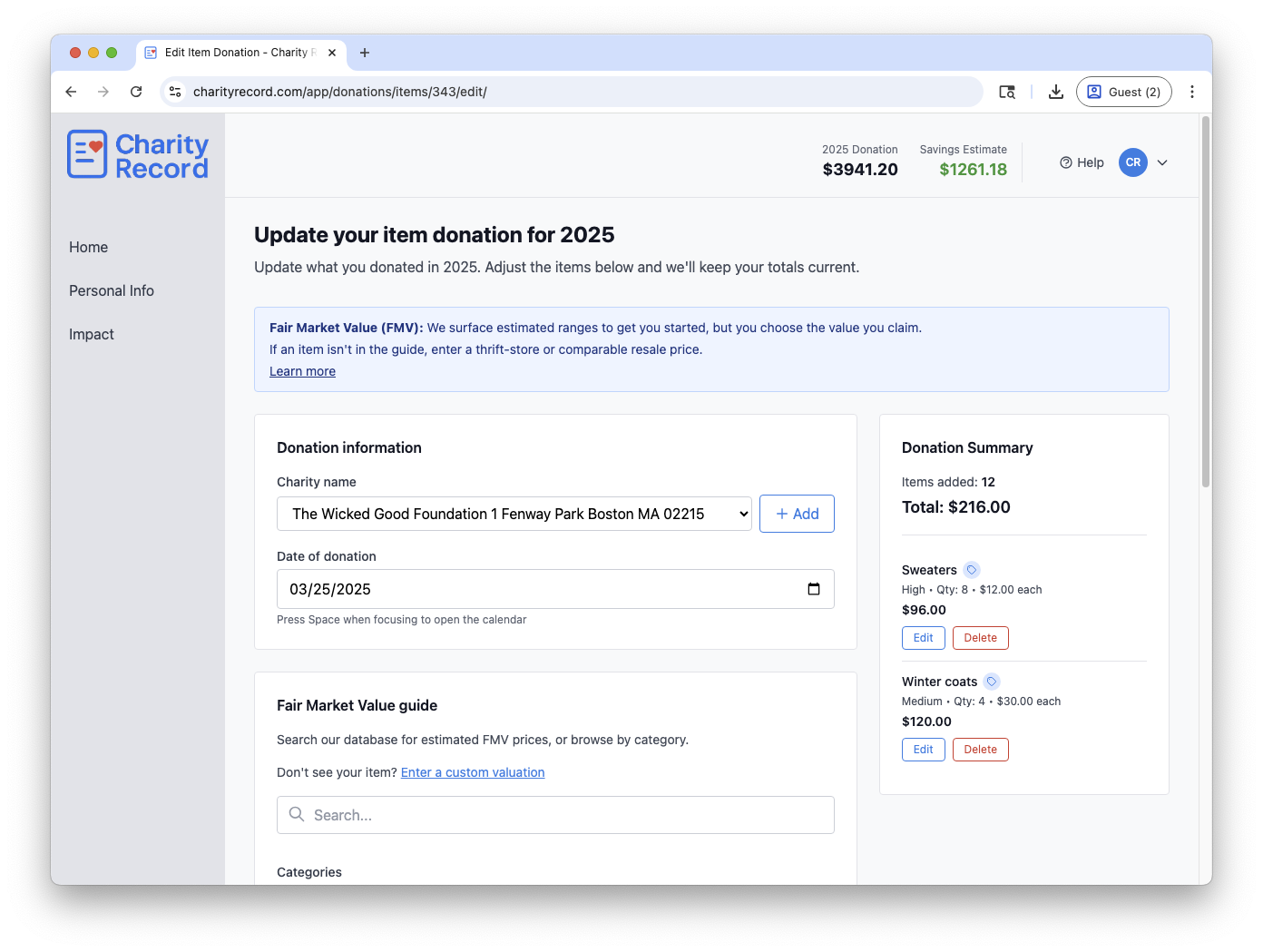

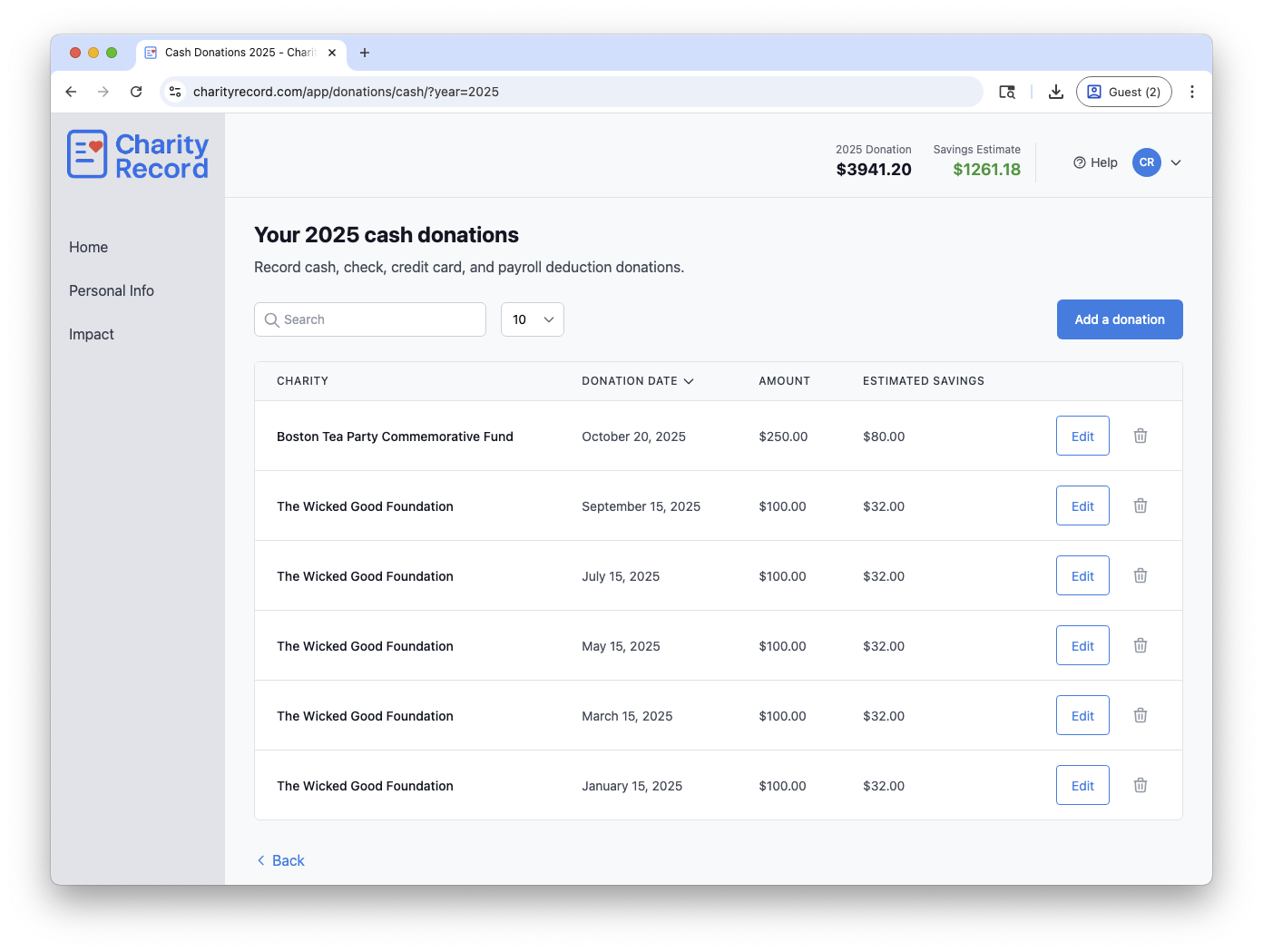

Track donations all in one place

Items, cash, mileage, stock, vehicles, digital assets, and art. Each donation type has its own tracking form with fields tailored to IRS requirements. No more scattered receipts or forgotten donations.

- Seven donation types supported with dedicated tracking forms

- Multi-year history stays accessible when you need it

- Running totals show your deductions at a glance

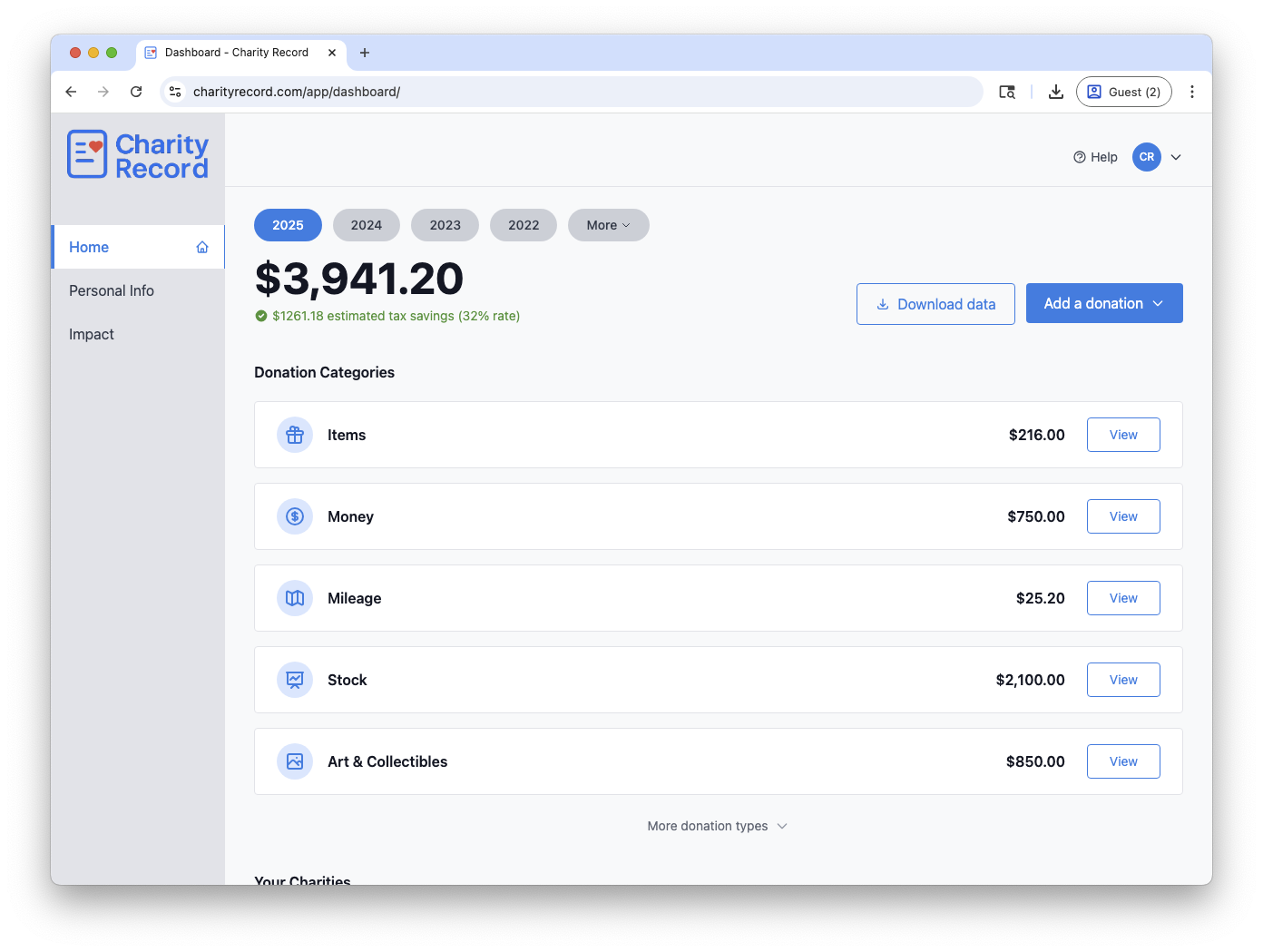

See your giving at a glance

Your dashboard shows running totals by donation type and estimated tax savings. Everything organized in one place.

- Running totals by donation type

- Estimated tax savings updated in real-time

- Switch between years to view past records

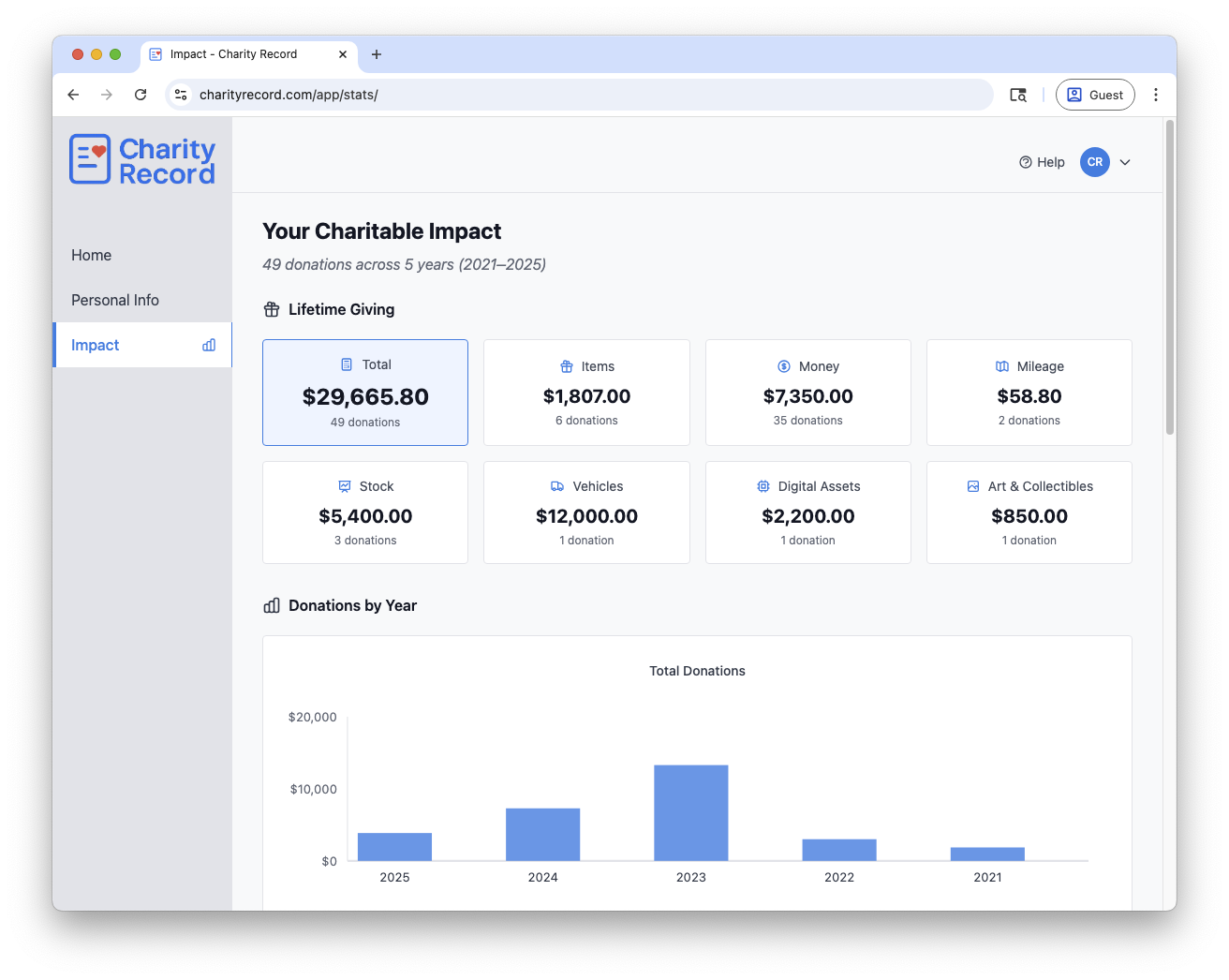

Track your giving over time

See year-over-year trends and understand your donation patterns. Multi-year history stays accessible when you need it.

- Year-over-year trends show your giving patterns

- Access historical data when you need it

- Understand donation patterns for better recordkeeping

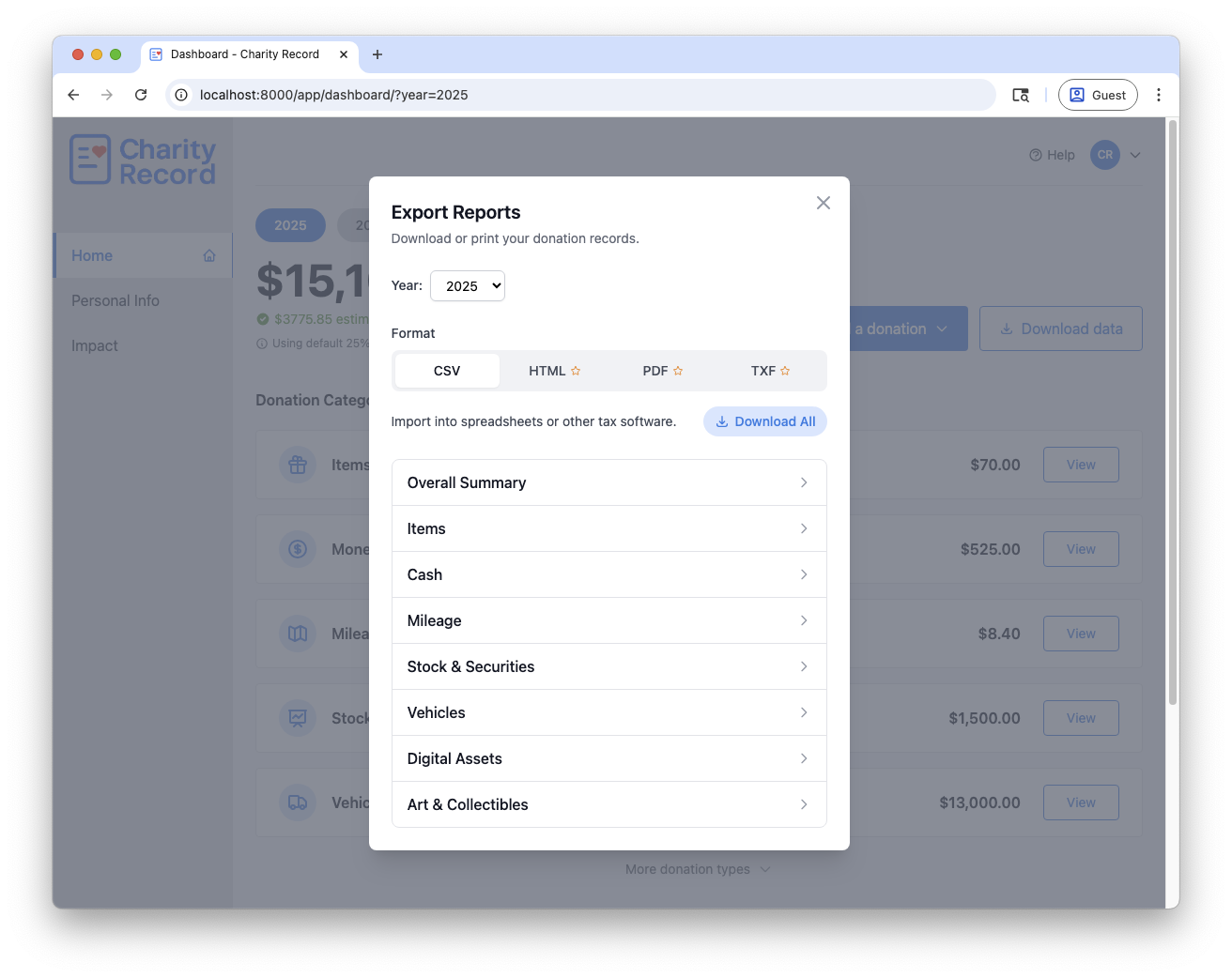

Export when you're ready

Export CSV, PDF, HTML, or TXF for tax software, printing, or sharing with your tax preparer.

- Export by year or donation type

- CSV, PDF, or HTML to reference while entering donations

- TXF imports into TurboTax Desktop and H&R Block Desktop (what to expect)

- Share with your tax preparer or reference yourself

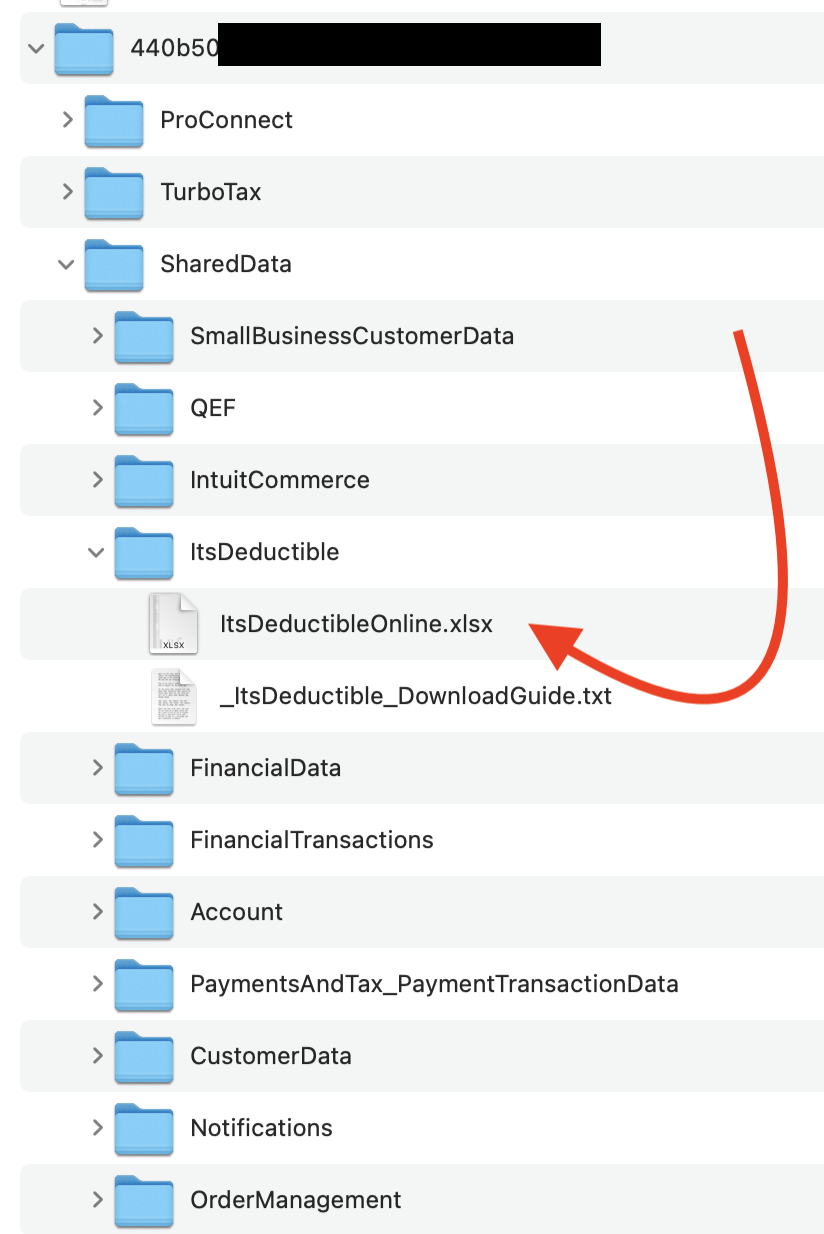

Import your donation history

Switching from ItsDeductible? Upload your historical data and bring years of donation records with you. Our importer detects duplicates automatically and lets you preview before finalizing.

ItsDeductible is a trademark of Intuit Inc. Charity Record is not affiliated with, endorsed by, or sponsored by Intuit.

- ItsDeductible-compatible import (CSV or XLSX format)

- Duplicate detection prevents double-counting

- Preview before import for confidence

Start free, upgrade when ready

Try it for up to $500 in donations tracked. Upgrade to unlimited tracking for $29.99/year, plus applicable tax.

Everything included

- Seven donation types supported

- Multi-year history that stays accessible

- Import from ItsDeductible (CSV/XLSX)

- Export CSV, PDF, HTML, or TXF for tax time

- Search 1,757 items for suggested valuations

Frequently Asked Questions

Seven types, each with its own tracking form tailored to IRS requirements:

- Items: Clothing, furniture, household goods

- Cash: Money, checks, credit card donations

- Mileage: Miles driven for charity

- Stock and securities: Publicly traded and private

- Vehicles: Cars, boats, aircraft

- Digital assets: Cryptocurrency, NFTs

- Art and collectibles: Paintings, antiques, rare items

Starting with tax year 2026, three changes to charitable deductions:

- Standard deduction filers: Can claim an above-the-line deduction for cash gifts up to $1,000 (single) or $2,000 (married filing jointly). This excludes donor-advised funds and private non-operating foundations.

- Itemizers: Face a 0.5% AGI floor. Only donations exceeding 0.5% of your adjusted gross income are deductible.

- Top bracket itemizers: The tax benefit of itemized charitable deductions is capped at 35%.

Either way, tracking year-round helps you maximize your deductions. Read our full breakdown or read H.R. 1 directly.

Start tracking your donations today

Free up to $500 in donations. Start tracking today.

Curious about the product? Explore the How It Works guide or review Pricing.