Recording Cash Donations

Summary: Record cash, check, card, or payroll deduction gifts in Charity Record. Choose one-time or recurring entries, keep receipt details, and use IRS Publication 526 for recordkeeping guidance.

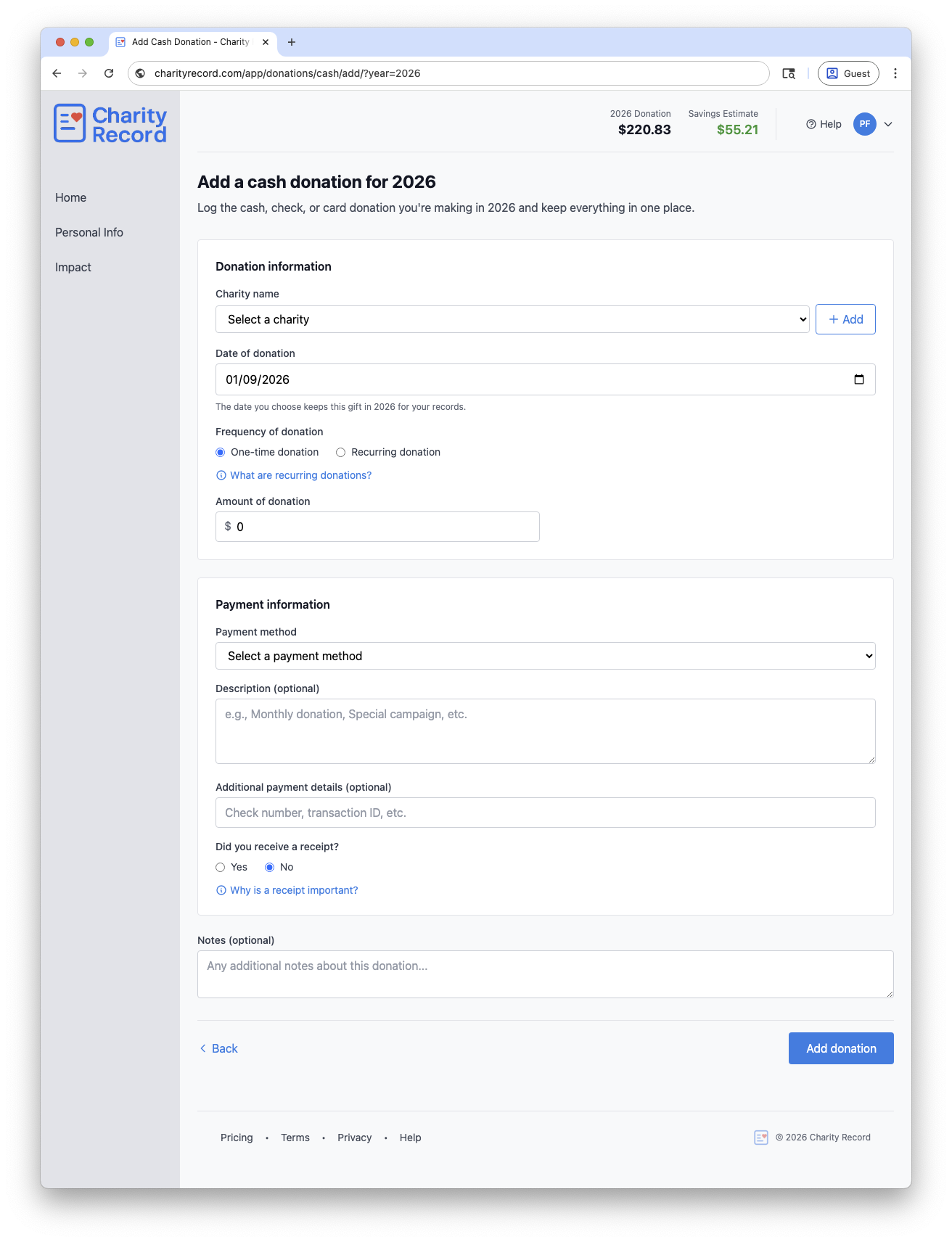

Add a cash donation

- Select the charity in the Charity name dropdown.

- Choose One-time donation or Recurring donation.

- Enter the Amount of donation or Amount per occurrence.

- If recurring, enter Donations per year.

- Choose a Payment method and fill in any optional details.

- Click Add donation.

If the charity is new, select + Create new charity or click Add to open the full charity form.

One-time vs recurring donations

One-time donation

- Use this for a single gift on a specific date.

- You will enter the Date of donation.

Recurring donation

- Use this when you give the same amount to the same organization multiple times in a year.

- The donation does not have to happen on the same day every month.

- Charity Record calculates the total amount for the year.

The What are recurring donations? link on the form includes examples and payroll deduction notes.

Receipts and acknowledgments

The Why is a receipt important? link on the form summarizes IRS receipt rules. In general:

- Keep bank or card records for smaller cash donations.

- Obtain a written acknowledgment for single contributions of $250 or more.

- For payroll deductions, keep your pay stubs or other employer records.

See IRS Publication 526 for the official requirements.

Payment details to record

These fields are optional but useful:

- Payment method (Cash, Check, Credit Card, Debit Card, Payroll Deduction)

- Additional payment details (check number, transaction ID)

- Did you receive a receipt?

- Notes

Edit or delete a cash donation

- Open the cash donation list for the year and click Edit.

- To remove it, click Delete and confirm in the modal.

Charity Record is a donation tracking tool, not a tax advisor. This article summarizes publicly available IRS guidance to help you use our software. You are responsible for ensuring your tax filings comply with IRS requirements. For complex situations such as quid pro quo gifts or payroll deduction documentation questions, consult a tax professional for advice specific to your situation.