How do I add a charity?

Summary: Add charities inline while recording donations or from the Your Charities page. You only need the charity's name to start, and you can fill in address or EIN details later.

There are two ways to add a charity

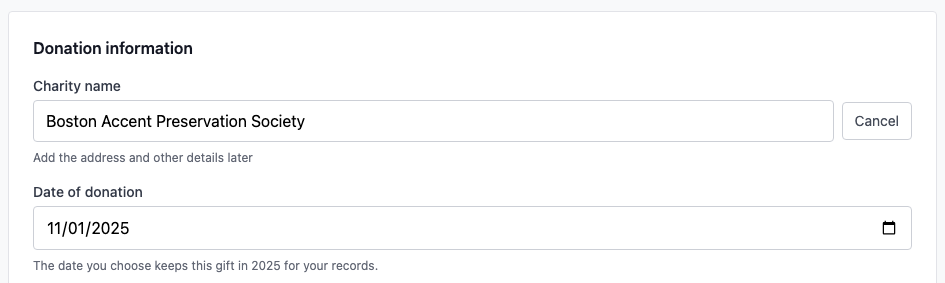

Method 1: Inline (while adding a donation)

Select "+ Create new charity" from the dropdown while recording a donation

Select "+ Create new charity" from the dropdown while recording a donation

When recording a donation: 1. In the charity dropdown, select + Create new charity 2. Enter the charity's name (saved automatically) 3. Continue filling out your donation 4. Add address, city, state, ZIP, and EIN later from Your Charities if needed

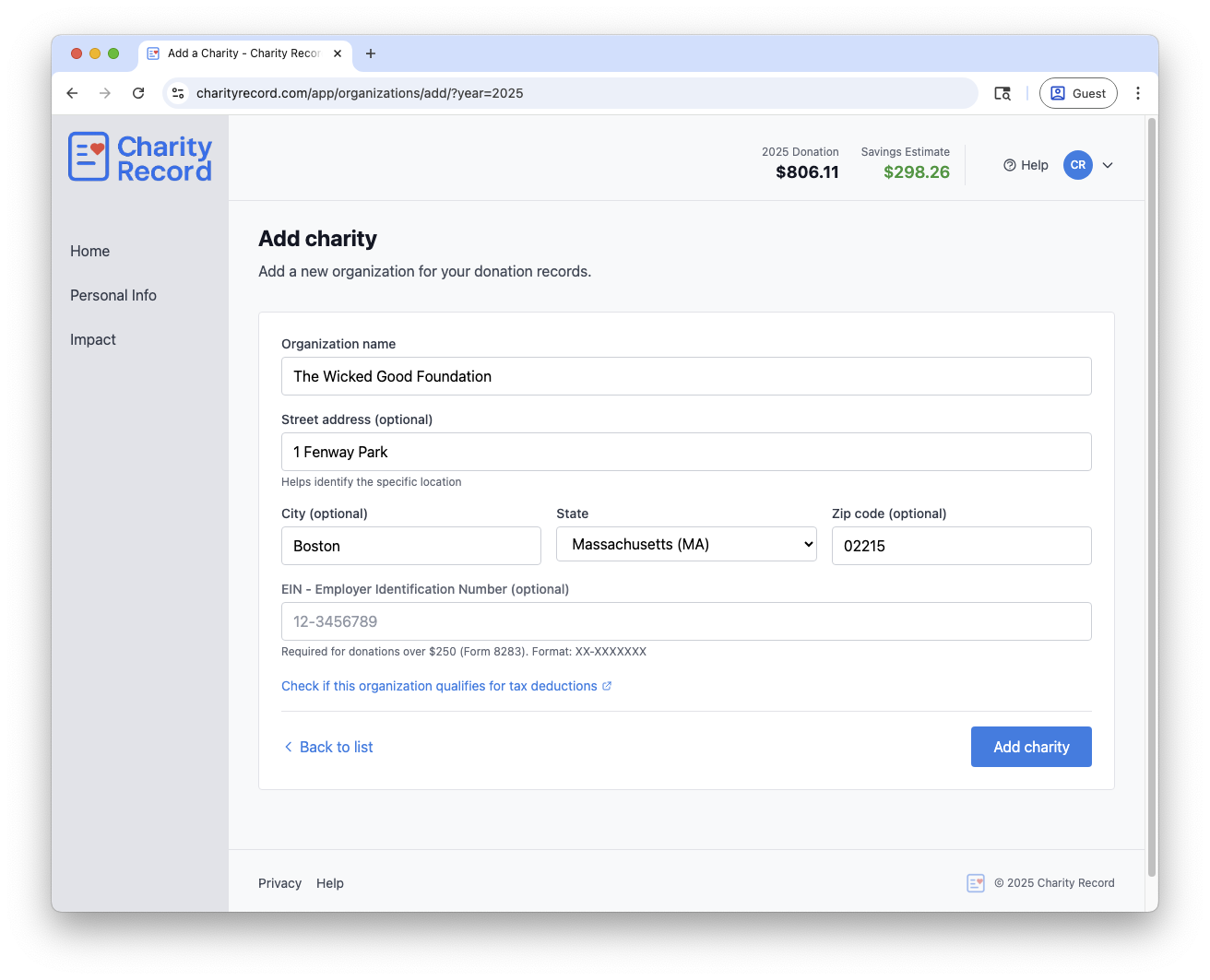

Method 2: From Your Charities page

Add charities from the dedicated Your Charities page

Add charities from the dedicated Your Charities page

From your dashboard: 1. Click Your Charities in the navigation 2. Click Add Charity 3. Enter the charity name and any details you already know (address and EIN may be required by your tax preparer or software) 4. Click Save

What information do I need?

Required:

- Charity name

Optional but helpful:

- Address

- City, state, ZIP code

- EIN (Employer Identification Number)

The IRS doesn't require you to track EINs for your own records, but some tax preparers or software may ask for them. EINs can also help verify the charity is qualified. You can look up EINs using the IRS Tax Exempt Organization Search.

Note: Not all legitimate charities are in the IRS database. Churches and small organizations with annual revenue under $5,000 aren't required to register.

Tips

Adding multiple charities? You can add them one at a time from Your Charities, or add them as needed when recording donations.

Donating to the same charity often? It will appear in your dropdown automatically for future donations.

Need to update charity info? Go to Your Charities and click the charity name to edit details. If you enter a charity name that already exists, we reuse the existing record so you don't have to merge duplicates later.

Charity Record is a donation tracking tool, not a tax advisor. Verify that organizations are IRS-qualified before claiming deductions.