Recording Item Donations

Summary: Record household items, clothing, furniture, and other non-cash goods you donate to charity. Use our FMV guide for quick estimates or enter your own values.

What is an item donation?

Item donations include clothing, furniture, electronics, kitchenware, and other household goods you give to charity. Common recipients include charitable thrift stores such as Goodwill and Salvation Army, plus other qualified 501(c)(3) organizations. Donations are deductible only if the organization is qualified.

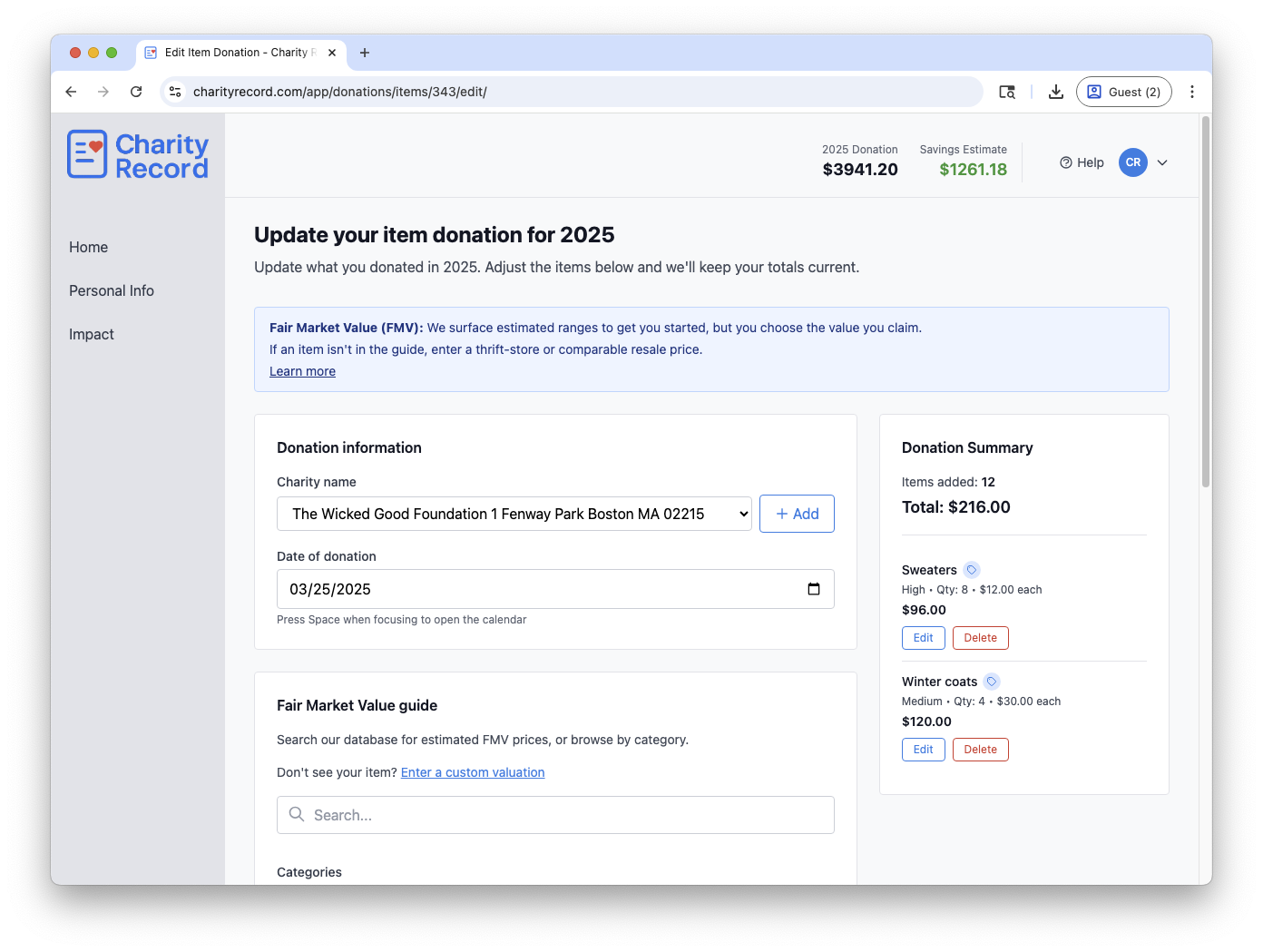

The item donation form with FMV guide and donation cart

The item donation form with FMV guide and donation cart

Tip: You can type a new charity name directly in the form, then add the address and other details later from your Charities list.

Fair Market Value (FMV)

Fair Market Value is the price a willing buyer would pay a willing seller for an item when neither is under pressure to buy or sell.

How to determine FMV for donated items

- Thrift store prices: What similar items sell for at Goodwill, Salvation Army, or other thrift stores

- Online marketplaces: Check eBay, Facebook Marketplace, Amazon (used), or Craigslist for comparable items

- Valuation guides: Use our FMV database (exported from ItsDeductible in 2025) as a starting point

- Original cost: Consider the original purchase price, age, and condition (more on cost basis)

Your responsibility

You are ultimately responsible for the valuations you claim on your tax return. The database contains estimates, but you should:

- Verify values are reasonable for the item's condition and market

- Keep documentation that supports your FMV (photos, receipts, and comparable listings are helpful)

- Get a qualified appraisal for non-cash donations in a category over $5,000 (and keep it with your records)

Conservative is safer

When in doubt, use a lower value. The IRS can challenge inflated valuations. It's better to be conservative than aggressive.

See IRS Publication 561 for official guidance on determining the value of donated property. Charity Record is not providing tax advice.

Quality options

According to IRS Publication 561, donated clothing and household items must be in good used condition or better to qualify for a tax deduction.

Quality levels in Charity Record

- High: Items showing little or no signs of wear, nearly new (good used condition)

- Medium: Items in good usable condition with moderate wear (average used)

- Other: Available for custom items (when you add your own item instead of using the Charity Record database)

Select the quality level that matches your item's condition

Select the quality level that matches your item's condition

Exception: Items not in good condition

You can deduct items in less than good condition if all of these apply:

- Single item value exceeds $500

- You obtain a qualified appraisal and attach it to your tax return

- You file Form 8283 Section B with your tax return

To record a less-than-good item: add it as a custom item, select Other, and add an explanation in the Valuation notes field.

See IRS Publication 561 for complete requirements.

The FMV guide

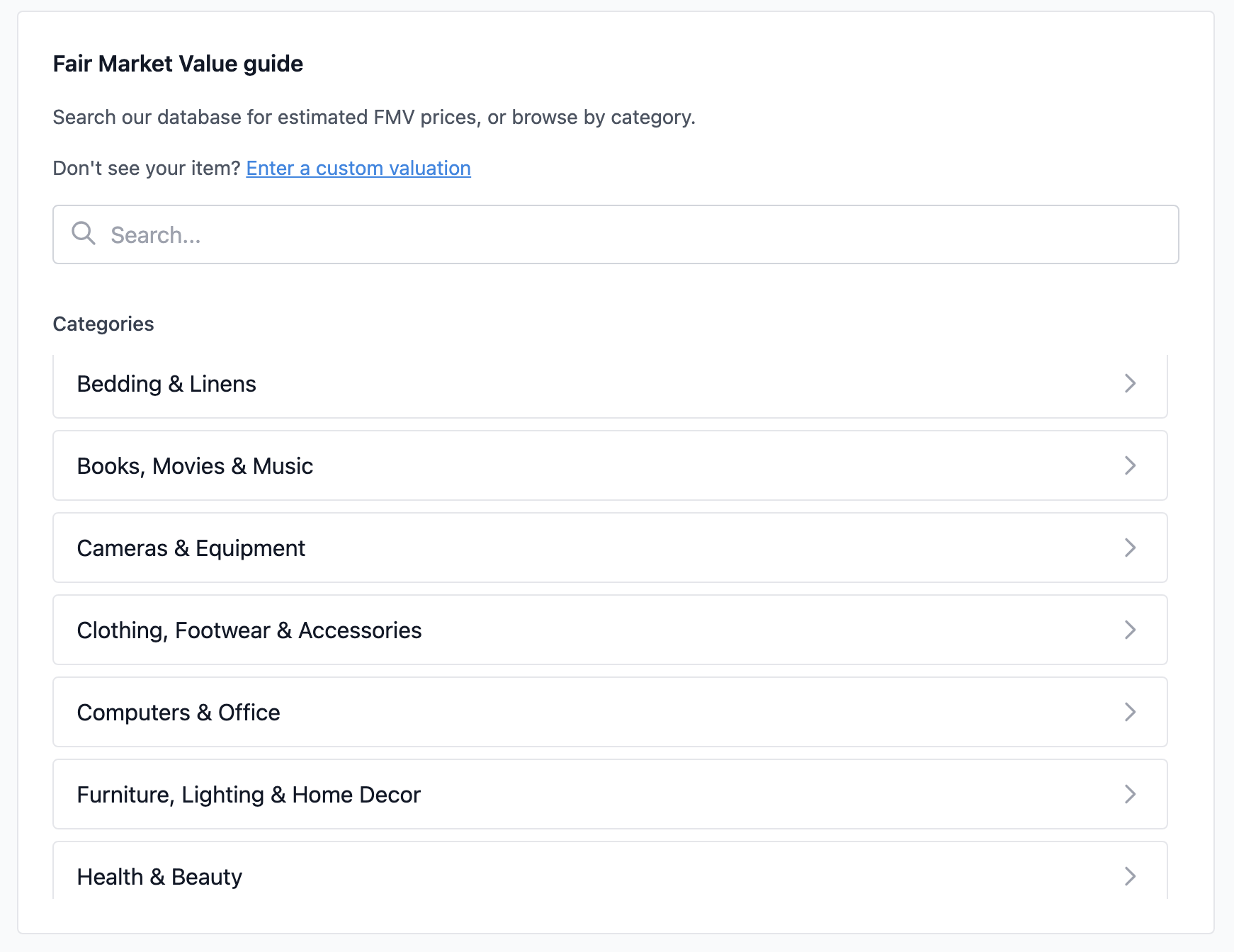

Our FMV guide provides estimated values for common donated items. Browse by category or search for specific items.

Browse categories

Click a category to see available items and their estimated values.

Browse categories to find your item type

Browse categories to find your item type

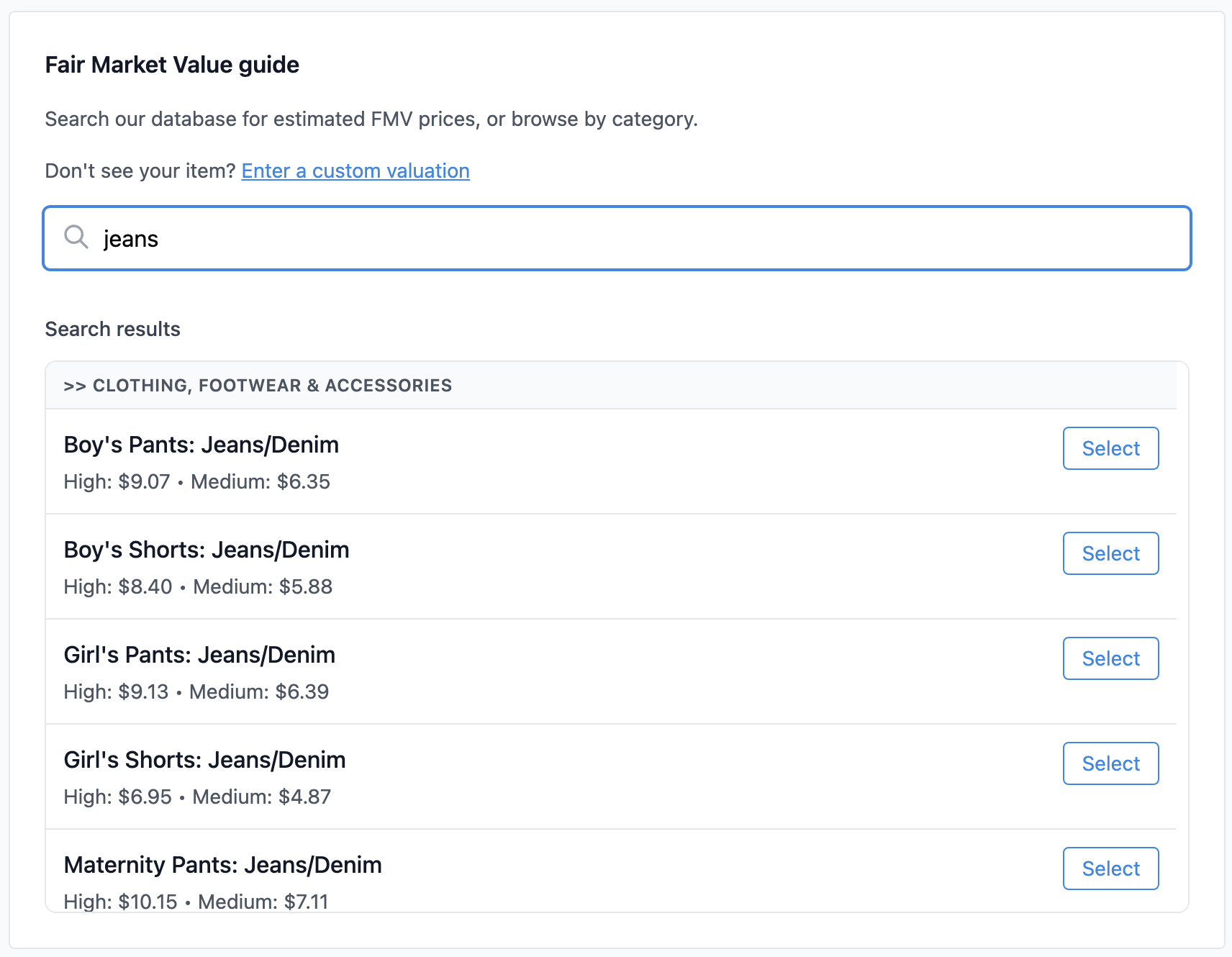

Search for items

Type a keyword to search across all categories. For example, search "jeans" to find all jeans-related items.

Search results show matching items with price ranges

Search results show matching items with price ranges

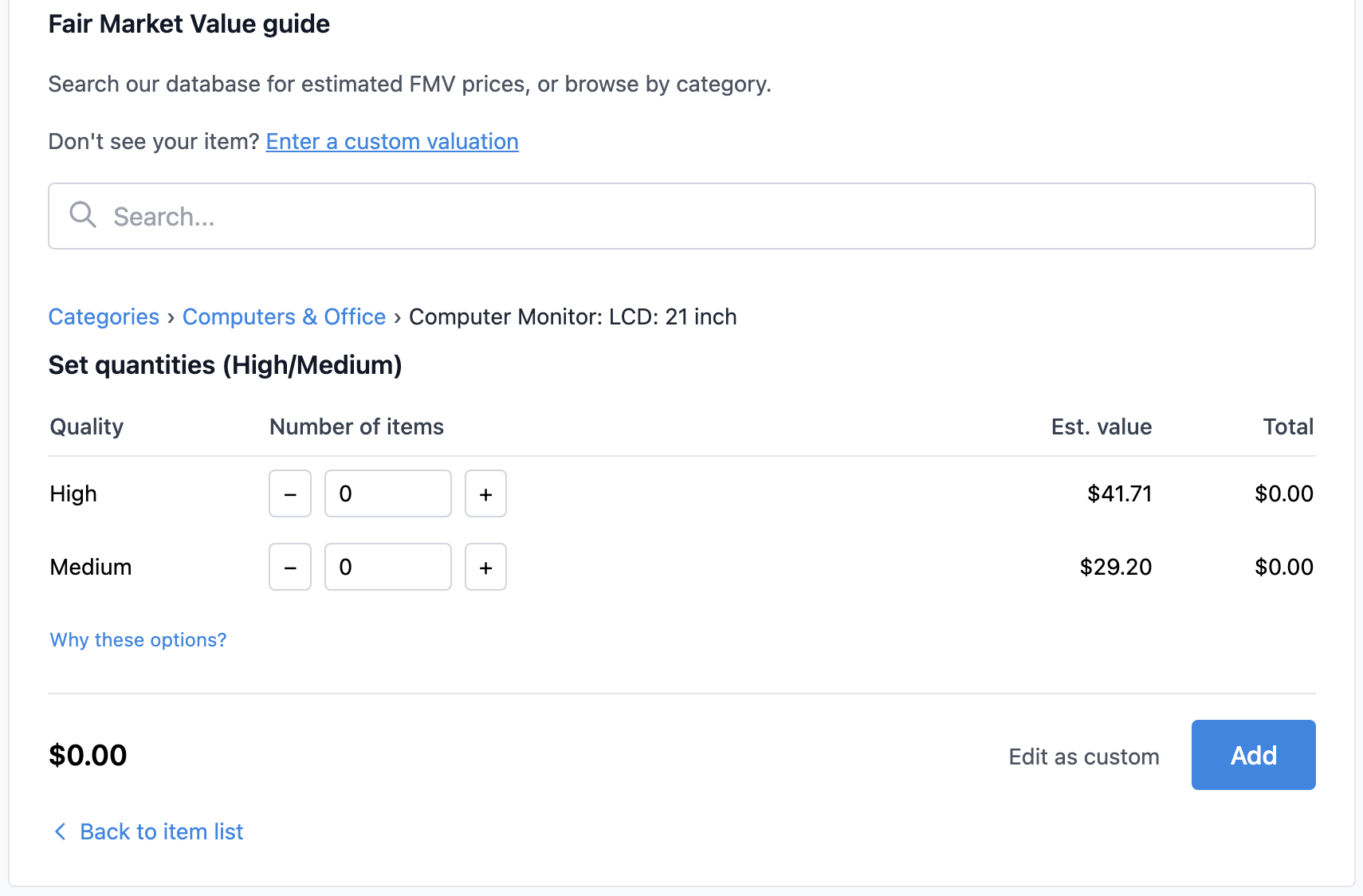

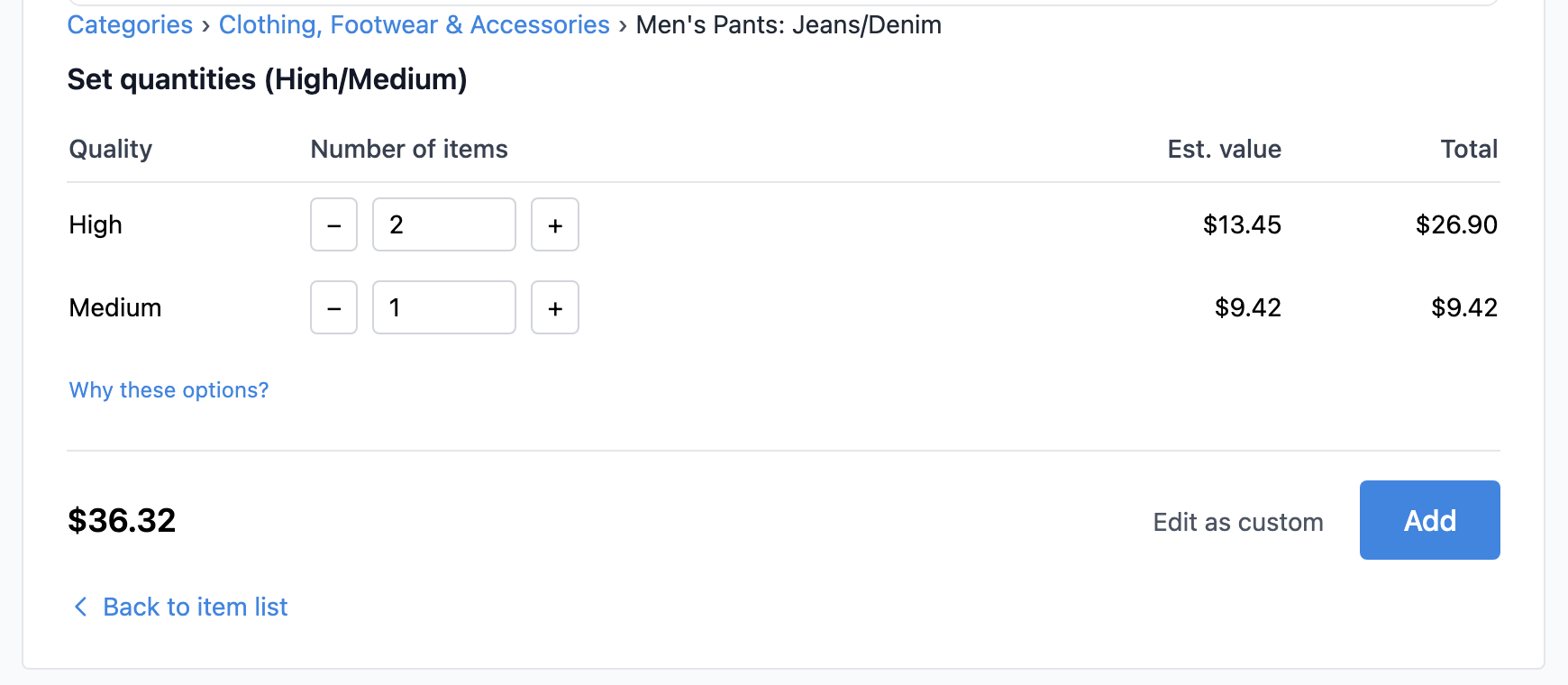

Add from the Charity Record guide

Select your item, choose quantity and quality levels, and click Add. The estimated FMV from the Charity Record database is automatically added.

Select quantity and quality, then add to your donation

Select quantity and quality, then add to your donation

See IRS Publication 561 for official valuation guidance.

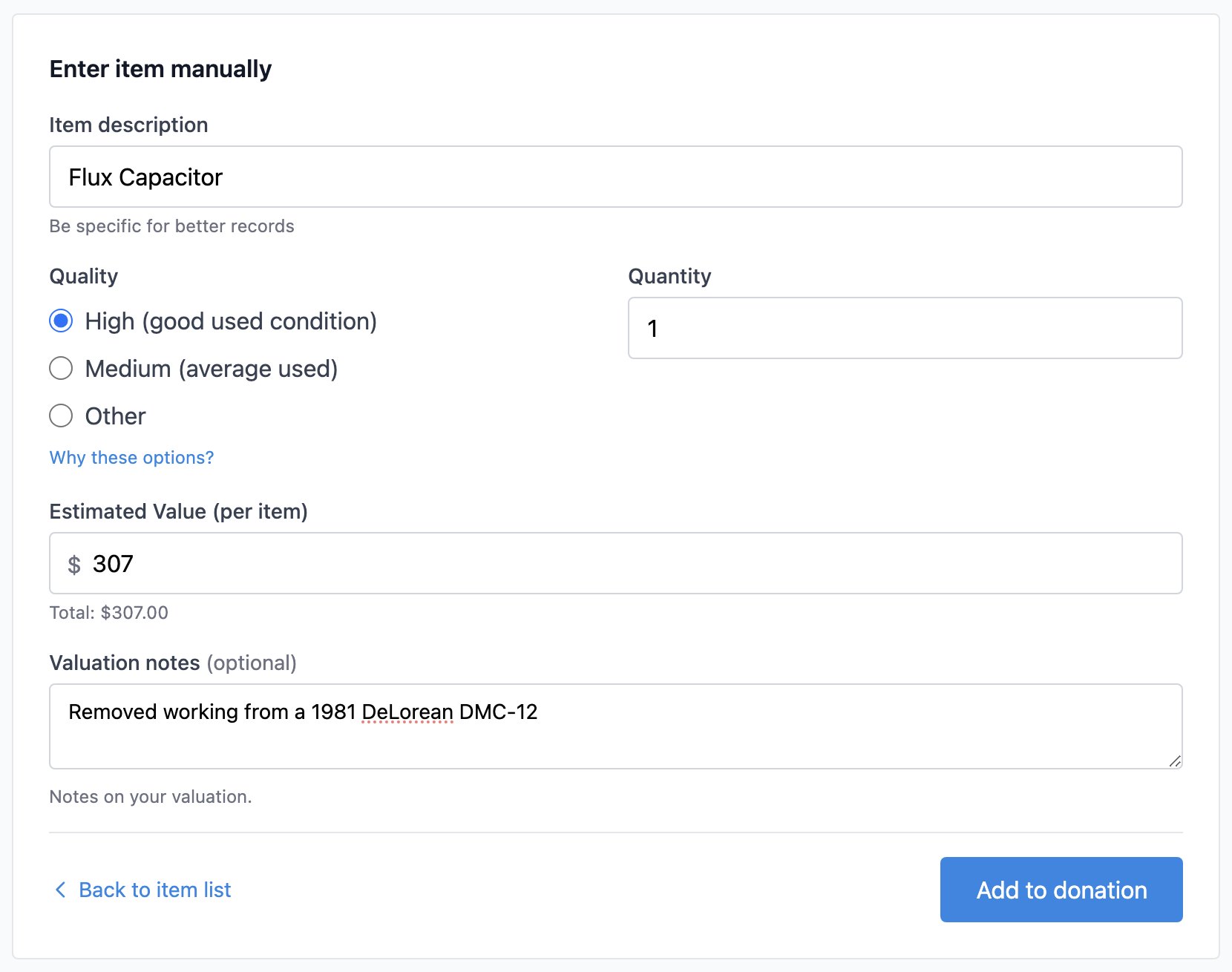

Custom items

If your item isn't in the FMV guide, add it as a custom item with your own description and value.

For a full walkthrough, see Custom items and submitting items to the guide.

When to use custom items

- Items not in the database (for example, luxury or specialty items)

- Items where you have better comparable sales data

- Items in less than good condition (select Other quality)

Add a custom item

- Click Add Custom Item

- Enter a description

- Select quality level

- Enter quantity and FMV per item

- (Optional) Add valuation notes explaining your FMV source

- Click Add to donation

You can also optionally submit a custom item suggestion for future guide review. See Custom items and submitting items to the guide for details on what gets submitted and how to turn that option off.

Enter description, quality, quantity, and your determined FMV

Enter description, quality, quantity, and your determined FMV

Valuation notes

Use the Valuation notes field to document how you determined the FMV. Examples:

- "Comparable eBay sold listings $45-60"

- "Thrift store prices for similar items $20-25"

- "Professional appraisal on file dated 1/15/2025"

This helps if the IRS ever questions your valuation.

See IRS Publication 561 for valuation methods.

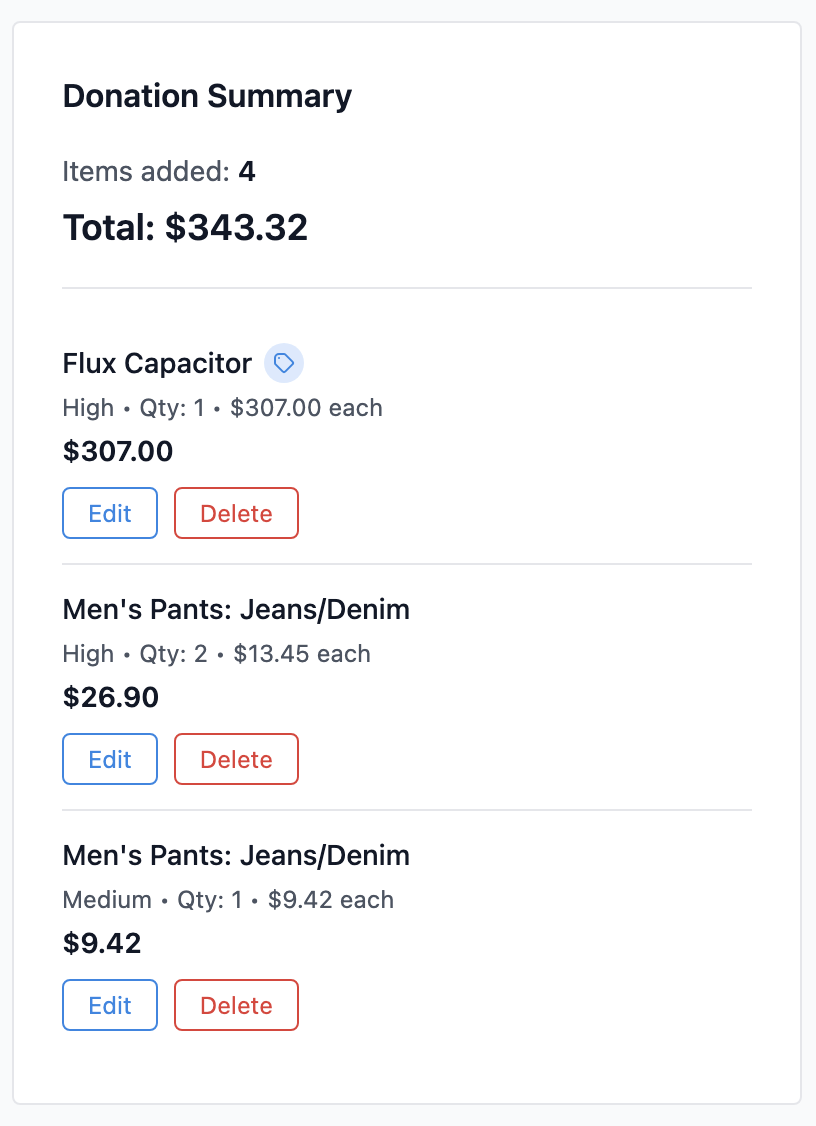

Your donation summary

As you add items, your donation cart shows the running total in the right sidebar.

Your cart tracks all items and calculates the total automatically

Your cart tracks all items and calculates the total automatically

Managing items

- Edit: Click Edit on an item to modify quantity, quality, or value

- Delete: Click Delete to remove an item from your donation

- Clear all: Remove all items and start fresh (button is located below the form)

Saving your donation

Click Save Donation below the form.

Record keeping

You are responsible for any documentation for your item donations. IRS substantiation rules depend on the size and type of the contribution.

Contributions of $250 or more (per donation)

You must obtain a contemporaneous written acknowledgment from the charity. It needs to describe the property and state whether you received any goods or services in return.

Non-cash deductions over $500

If your deduction for non-cash contributions is more than $500 (including groups of similar items), you generally must file Form 8283 Section A. You should also keep records of how and when you acquired the item and your cost or other basis.

Non-cash deductions over $5,000

If your deduction for an item or group of similar items is more than $5,000, you generally must obtain a qualified appraisal and file Form 8283 Section B (with the charity’s signature).

Clothing or household items not in good used condition

If a single clothing or household item is not in good used condition and you deduct more than $500, you must obtain a qualified appraisal and attach it to your return, and complete Form 8283 Section B.

See IRS Publication 561, IRS Publication 526, and the Form 8283 instructions for complete requirements.

Form 8283 requirements

Non-cash donations over $500 require Form 8283 with your tax return. Charity Record tracks the information you'll need to complete this form.

For more details, see our Form 8283 Basics guide.

See IRS Form 8283 instructions for complete requirements.

Charity Record is a donation tracking tool, not a tax advisor. This article summarizes publicly available IRS guidance to help you use our software. You are responsible for ensuring your tax filings comply with IRS requirements. For complex situations, consult a tax professional for advice specific to your situation.