ItsDeductible Alternative for 2025 Taxes: Charity Record

Charity Record

charityrecord.com/If you used ItsDeductible to track your charitable donations, you've now noticed it's shut down. Intuit sunset ItsDeductible on October 21, 2025, leaving a large number of users without a donation tracker before tax season.

Here's how to handle your 2025 charitable deductions with Charity Record.

Your ItsDeductible data isn't lost

Even though ItsDeductible shut down, your donation history still exists. Intuit lets you request a data export containing all your ItsDeductible records.

Intuit says the process can take up to 15 days, though some of our users report it took less time. You'll get an XLSX spreadsheet with your complete donation history, which you can then use directly or import to an ItsDeductible alternative like Charity Record.

We have a complete guide to exporting your ItsDeductible data, including screenshots of every step.

Tracking donations going forward

With ItsDeductible gone, you have a few options for a replacement. We wrote a full guide on tracking charitable donations for tax deductions that covers the tradeoffs, but here's the short version:

- Spreadsheets work but require manual value lookups and formatting for tax time.

- Paper logs are IRS-acceptable (but inconvenient – you can't search them, after all!).

- Dedicated tracking apps like Charity Record handle the tedious parts: FMV lookups, organization by date and charity, and tax exports.

Charity Record is our tool. We built it after ItsDeductible shut down because we needed a replacement ourselves (our developer's wife was our most thorough tester!). It imports ItsDeductible data directly, has a built-in FMV database, and exports to CSV on the free tier, with PDF, HTML, and TXF on the paid plan – a format your tax software might be able to import.

And you don't need to be a former ItsDeductible user to benefit. Anyone tracking charitable donations can use Charity Record as a standalone tracker.

Track donations year-round, then export at tax time

Track donations year-round, then export at tax time

What TurboTax users should know

TurboTax still lets you enter charitable donations during tax filing. But Intuit has no standalone tracker anymore.

- TurboTax Online doesn't support importing donation data from external files. You'll enter donations manually, using documentation (or exports from a dedicated tool) to help you.

- TurboTax Desktop supports TXF import to a reasonable level of detail. If you track donations elsewhere and export to TXF, you can import the file directly.

As a note, H&R Block Desktop also supports TXF import, though the process differs slightly.

For any tax software (well, even if you do your taxes by hand...), you can also use spreadsheet, PDF, or HTML exports as reference while entering donations manually, or share them with your tax preparer. See our sample exports to preview the formats.

We built Charity Record because we needed it

We were all ItsDeductible users ourselves. When Intuit shut it down for good in October 2025, we built what we wished existed: a modern donation tracker that works on any device, picks up where you left off with your old data, and exports in logical ways.

We use it constantly. That's why features like item autosave exist. We got tired of losing our donation list when something interrupted us mid-entry back in the ItsDeductible Days.

And our early users agreed:

"I find this program easier than It's Deductible. There is a warning that information not saved before navigating away which helps with repeating entry of information. The [s]aved draft feature is also nice" – Former ItsDeductible user

But that's not the only new feature we added...

What Charity Record does the same – and differently – as ItsDeductible

ItsDeductible tracked four donation types. We support seven, matching more categories on IRS Form 8283:

- Items (clothing, household goods, furniture)

- Cash (money, checks, credit card, payroll deduction)

- Mileage (miles driven for charitable purposes)

- Stock & securities (public and private)

- Vehicles (cars, boats, RVs)

- Digital assets (Bitcoin, Ethereum, NFTs)

- Art & collectibles (paintings, sculptures, coins)

Beyond donation types, we added features ItsDeductible never had:

Item autosave. Your donation list saves automatically as you work. If you get interrupted, you can restore where you left off.

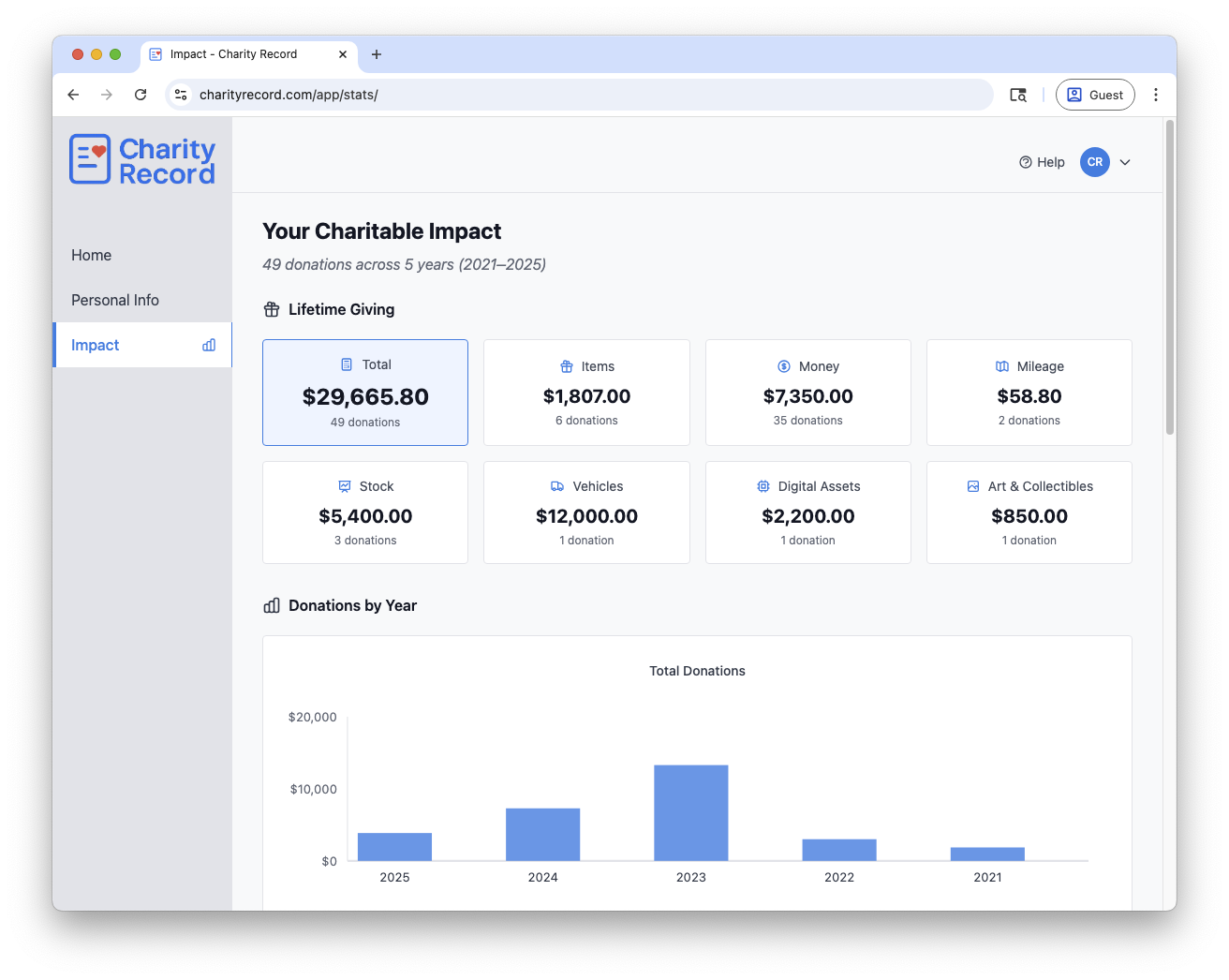

Impact dashboard. See your giving history with year-over-year comparisons, top organizations, and totals by donation type.

See your giving patterns over time

See your giving patterns over time

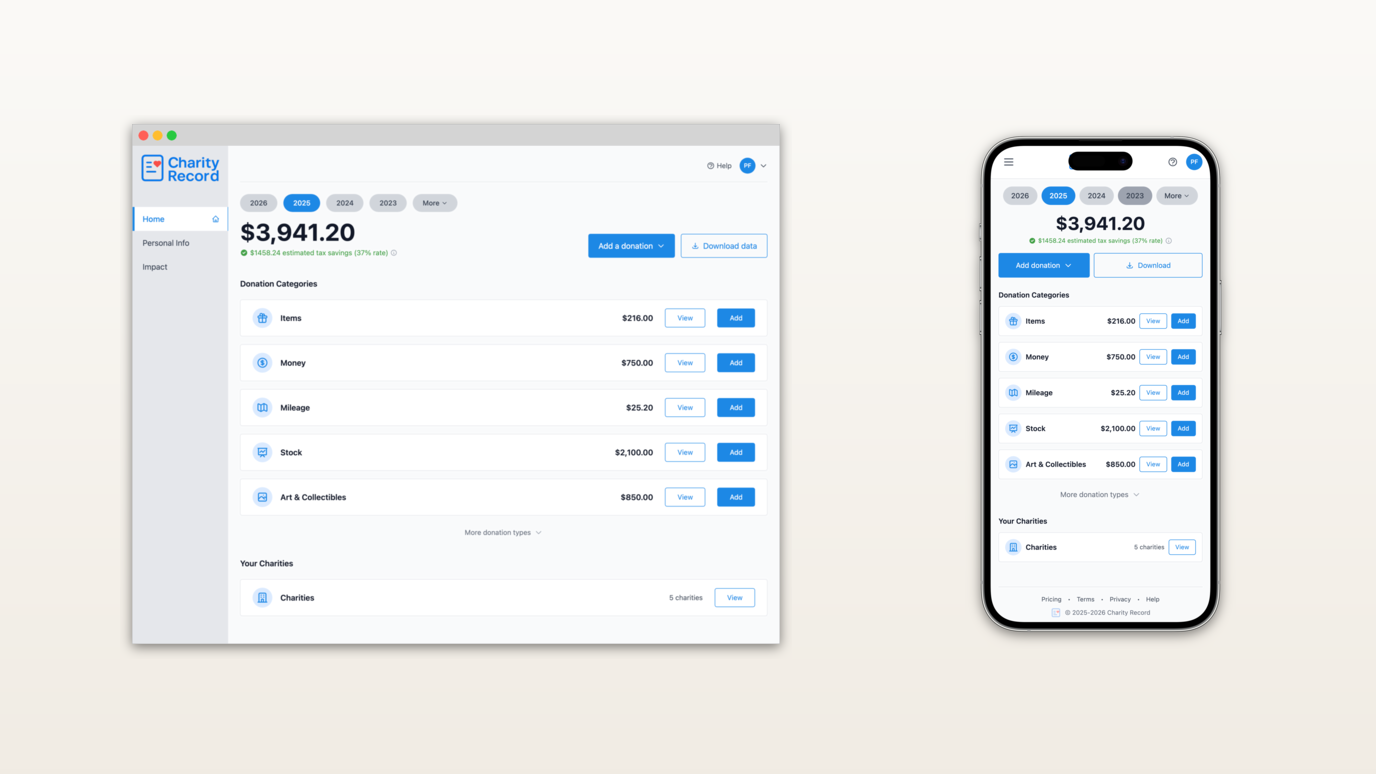

Modern web app. With Charity Record, there's no software to install. It works on your phone, tablet, or computer. Your data syncs automatically so you can track donations from anywhere.

Multiple export formats. CSV on the free tier, with PDF, HTML, and TXF on the paid plan. Use what works for your tax situation.

Data ownership. Export your data anytime. If you ever want to leave, your donation history goes with you. (Though we'd be sad to see you go!)

Filing your 2025 taxes

For a quick reference on what the IRS requires for charitable deductions, see our receipt requirements guide and Form 8283 overview.

The short version: keep records for everything, get written acknowledgments for donations over $250, and file Form 8283 if your non-cash donations exceed $500. And if you want to streamline things, Charity Record can help.

And ongoing tracking? We're ready for that, too.

Track as you go

Tax season aside, the real benefit of a donation tracker isn't at tax time. It's the ability to log donations throughout the year and have everything ready when you file.

Drop off clothes at Goodwill? Log it in 30 seconds. Write a check to your church? Add it before you forget the amount. Donate stock through your brokerage? Record the details while they're fresh.

When tax season arrives, export and answer a few questions from your tax software or CPA, and you're done.

"Much easier than It's Deductible. Due to warnings about entries not saved and the saved draft feature, I don't have to repeat duplicate entries as often" – Beta tester and former ItsDeductible user

Tracking your charitable donations in 2026

We may be in 2025 tax season, but I know you're also thinking about your charitable donations in 2026.

The One Big Beautiful Bill Act changed charitable deductions starting in 2026. The mechanics shift in two ways: itemizers have a new AGI floor, and standard‑deduction filers get a limited above‑the‑line deduction for cash donations.

Charity Record already reflects the 2026 rules in our tax estimates. For a full breakdown with examples, see our 2026 charitable deduction changes post.

Get started

If you used ItsDeductible, export your data from Intuit before you forget. The process is free but takes time.

Charity Record is the ItsDeductible replacement you're looking for in 2025... and in 2026 and beyond. It imports your ItsDeductible history if you've got it, and works as a standalone tracker for new donations. We're free up to $500 in donations tracked, then $29.99/year. No credit card required to start.

For more on how we compare to ItsDeductible, see our ItsDeductible alternative page.

ItsDeductible is a trademark of Intuit Inc. Charity Record is not affiliated with, endorsed by, or sponsored by Intuit.

More resources:

About Charity Record

The Charity Record Team

Ready to track your donations?

Create a free account and start organizing your charitable giving for tax time.

Create Free AccountFree up to $500 in donations. No credit card required.